The price of Athena retreated for three consecutive days as exchange balances continued to grow and whales sold their tokens.

Athena (This) token fell to $0.95, moving below the psychologically important $1 level for the first time since December 20.

The ongoing crash is caused by the feeling of risk in the crypto industry, which has caused Bitcoin (BTC) and other prices to be lower.

It also happened as the data on the chain showed that the whales were selling their tokens. U larger transactions it happened when a whale sent 11.6 million ENA tokens worth $11 million to Binance, the largest crypto exchange. In another transaction, a trader moved ENA tokens valued at $10.7 million to Binance.

Athena whales unloaded $30 million worth of tokens on Thursday, December 26th. These sales occurred a week after Arthur Hayes, Bitmex founder and early investor, he sold some of his ENA tokens. According to Nansen, Hayes now has 18,616 coins valued at $17,458.

Athena’s price also fell as tokens on exchanges continued to rise, a popular bearish view. These tokens have increased by 5.82% in the last seven days to more than 730.27 million. The total offer on the exchanges moved to 4.87%, from 0.27% a week ago.

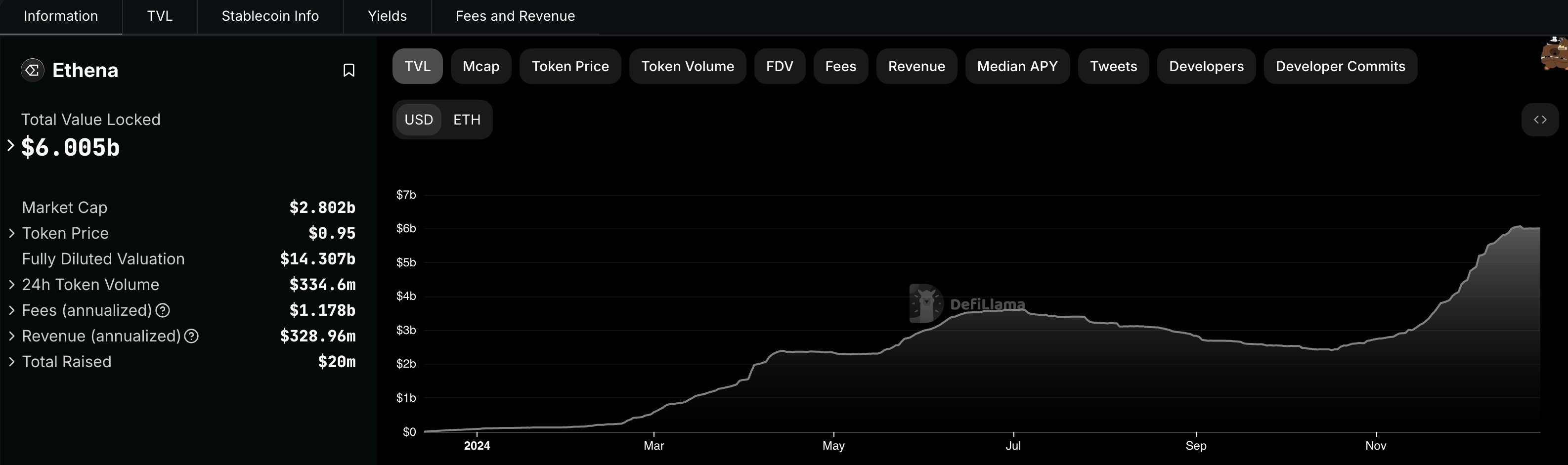

Meanwhile, inflows into Athena’s USDe stablecoin have stalled. The coin has a market capitalization of $6 billionwhere it has been in the past few days, a sign of slow demand.

Athena price analysis

Technicals suggest that Athena may have more descent to go as it formed a head and shoulders pattern on the four hour frame. This model includes a neckline, which is $0.8552, two shoulders and a head. In most periods, the pattern leads to a strong downward momentum when it moves below the neck.

Athena also moved to the 38.2% Fibonacci Retracement level and slipped below the 50-period moving average. It also fell below the strong reverse pivot level of the Murray Math Lines.

Therefore, the token will likely continue to fall, with the immediate target being the H&S neck at $0.8552. A drop below that level would point to further downside, potentially to the extremely oversold level of $0.5860.

Disclosure: This article does not represent investment advice. The content and materials presented on this page are for educational purposes only.