The price of Ethereum retreated on Boxing Day as the gains made during the Santa Claus rally were erased.

Ethereum (ETH) token fell to $3,340, up 5.6% from its highest level this week. This withdrawal occurred as a sea of red spread across the crypto industry, with the market capitalization of all coins falling to $3.29 million.

Ethereum crashed in a low-volume environment as most traders stayed away from the market during the Christmas holidays. CoinGecko data shows that the 24-hour volume was $17.5 billion, up from $24 billion a day earlier. It had its lowest volume in more than a month.

Ethereum futures open interest also continued to decline, reaching a low of $26 billion, down from the month’s high of $28 billion. Falling open interest is a sign of falling demand among futures traders.

However, there are some positive signs in the Ethereum market. Given by Call it DeFi shows that the total value locked in its DeFi ecosystem has grown by 5.50% in the last 30 days. Solana and Tron’s TVL fell by more than 3% in that period.

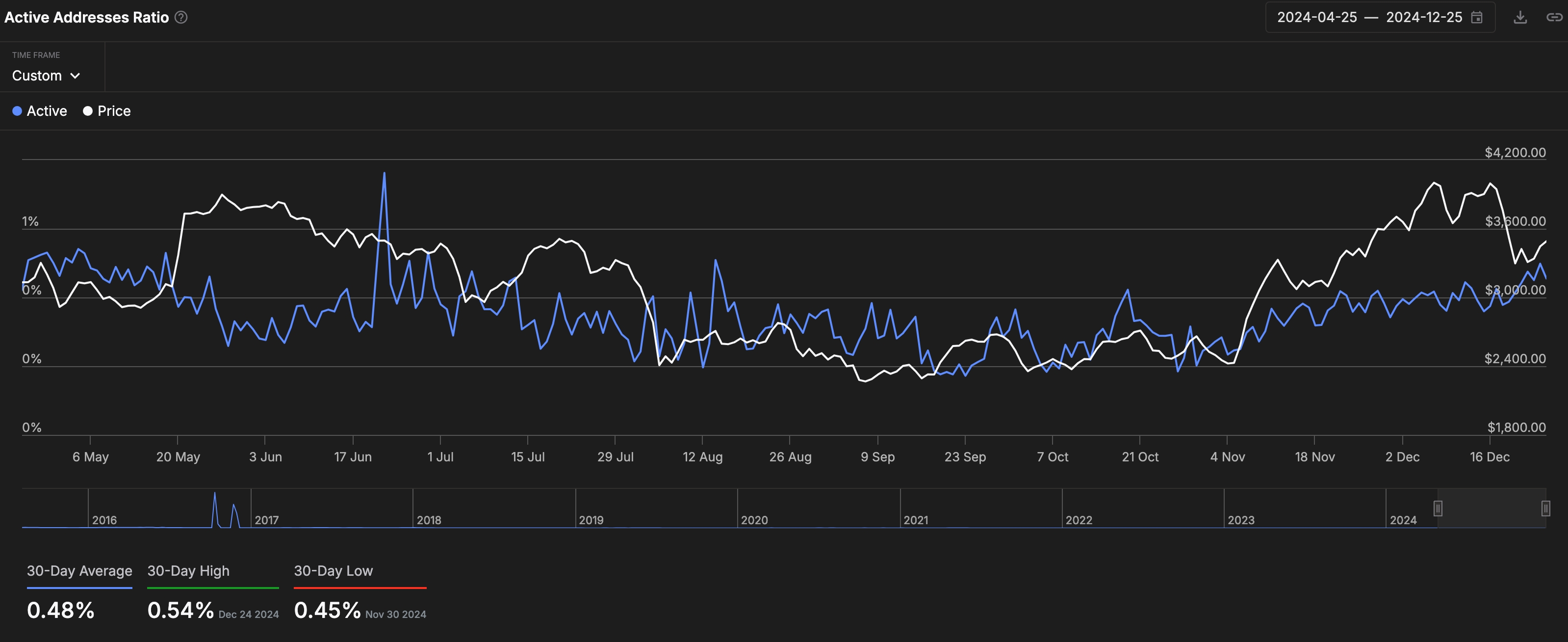

The ratio of active addresses has continued to grow in recent months. It rose from an October low of 0.37% to 0.57%, its highest level since August. This important data point shows the ratio of active addresses to balances with balances. Total active Ethereum addresses have risen to over 927,000.

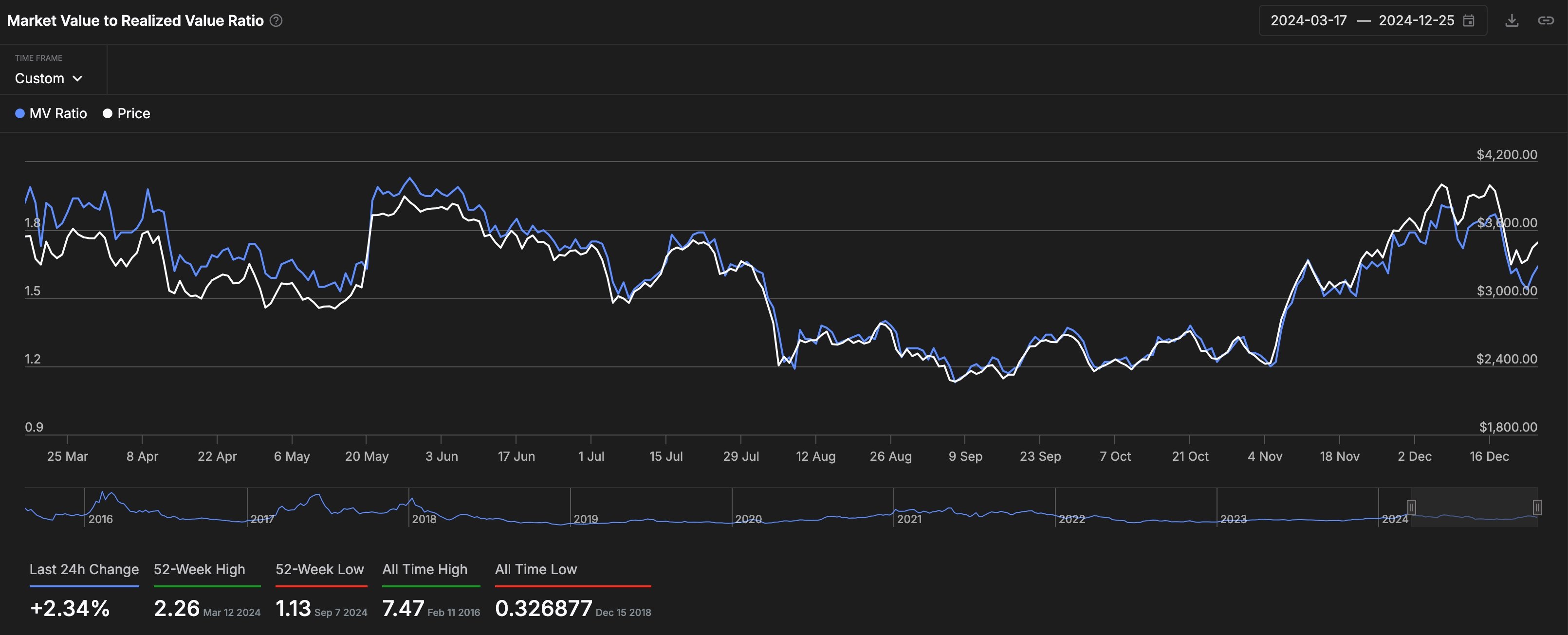

More technical data shows that the market value of Ethereum at the realized value has increased by 2.35% in the last 24 hours to 1.64. This important number shows whether a crypto asset is overvalued or undervalued. An Figure MVRVA of less than 3.8 indicates that an asset is relatively undervalued.

Ethereum price analysis

The daily chart shows that ETH price formed a small double top pattern at $4,095 and then made a strong bearish breakout. It then bounced back and tested the pattern’s neckline at $3,500, its swing low on December 3.

ETH formed a small doji candlestick pattern on Christmas Day. A doji consists of a small body and long and upper shadows and is usually a bearish sign. Ethereum has also formed a bearish flag chart pattern.

Therefore, the coin will probably have a bearish encounter and reach the psychological point at $3,000, down 10% below the current level.

Disclosure: This article does not represent investment advice. The content and materials presented on this page are for educational purposes only.